Kenya Lowers Tax on British Alcohol: What This Means for Consumers and Businesses

Kenya has lowered the tax on British wines, gin, and whiskies to 25%, resolving a dispute with the UK. This move makes these premium drinks more affordable and supports local businesses. Read the full blog to learn more about this trade development.

In a recent policy change, Kenya has reduced the tax rate on British-made alcoholic beverages, including wines, gin, and whiskies. This move comes after the UK formally complained about higher taxation on its products. The new tax rate is set at 25%, aligning with the terms of the Economic Partnership Agreement (EPA) between Kenya and the UK.

Previously, Kenya charged a 35% tariff on these British alcoholic beverages, a rate that exceeded the 25% duty agreed upon in the EPA. This discrepancy led to a formal complaint from the UK earlier this year. The situation has now been resolved, with Kenya lowering the tax to 25% as per the trade agreement.

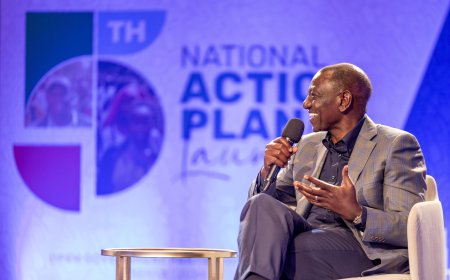

UK High Commissioner to Kenya, Neil Wigan, confirmed that the two countries had worked together to resolve the issue. He stated, "We have worked very closely with the Ministry of Trade and resolved that. The tariff is now at 25% as provided for in our trade agreement with Kenya." This resolution reflects a positive step in enhancing trade relations between Kenya and the UK.

Impact on Kenyan Market and Consumers

For Kenyan consumers, this tax reduction means that British wines, gin, and whiskies will become more affordable. Previously, the higher tax rate had made these premium drinks more expensive, which could have dampened their popularity among local consumers. With the new lower tax rate, consumers can now enjoy these imported beverages at more reasonable prices.

For local businesses, the tax cut is expected to have a significant impact. Importers of British alcohol had been facing challenges due to the higher tax rate, which affected their pricing and sales. The reduction in tax should help local retailers and distributors offer these products at competitive prices, potentially boosting sales and improving market dynamics.

Strengthening Trade Relations

The resolution of this tax issue is also a step forward in strengthening trade relations between Kenya and the UK. As UK High Commissioner Neil Wigan noted, "In the same way that Kenyan exporters are benefitting from duty-free exports of flowers to the UK, British companies will benefit from what we have resolved." This move highlights the commitment of both countries to enhance trade and investment cooperation.

Read:

Kenya's Ministry of Investments, Trade, and Industry, led by Cabinet Secretary Salim Mvurya, has been actively working to resolve trade issues with the UK. Mvurya emphasized that these efforts are aimed at bolstering trade and investments between the two nations. Notably, the UK is making significant investments in Kenya, including the Nairobi Railways City project.

What's Your Reaction?