Kenya to Legalize Bitcoin and Cryptocurrencies: New Policy Framework Targets Growth and Risk Management

A new bill in Kenya proposes taxation and regulation of cryptocurrency trades, introducing measures for digital wallet oversight and transaction transparency.

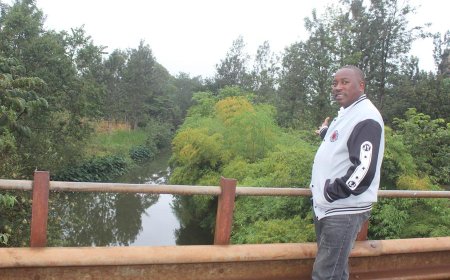

The Kenyan government is taking decisive steps toward regulating cryptocurrencies, marking a pivotal shift in its financial policy landscape. On January 10, 2025, Treasury Cabinet Secretary John Mbadi announced plans to establish a comprehensive legal framework for virtual assets (VAs) and virtual asset service providers (VASPs). The move aims to foster innovation while mitigating risks such as money laundering, terrorism financing, and fraud.

In his announcement, Mbadi highlighted Kenya's strong legacy of financial innovation, including the groundbreaking success of mobile money services like M-Pesa. He emphasized the government’s commitment to positioning Kenya as a leader in the evolving digital economy. The proposed regulations are designed to create a fair, competitive, and stable market for cryptocurrencies, enhance financial literacy, and ensure consumer protection.

Taxation and Oversight: Capital Markets Amendment Bill

Parallel to the government’s initiative, the National Assembly’s Finance and National Planning Committee has endorsed the Capital Markets (Amendment) Bill, 2023, spearheaded by Mosop MP Abraham Kirwa. This legislation seeks to redefine digital currencies as securities under the Capital Markets Act, enabling taxation on cryptocurrency transactions.

The bill proposes the introduction of transaction taxes akin to excise duties on banking activities. Crypto exchanges and digital wallets would be taxed, while individuals dealing in digital currencies must disclose key financial details, including transaction proceeds, costs, and profits, to the Capital Markets Authority (CMA).

Kenya's proactive approach mirrors global efforts to regulate digital currencies while maximizing their potential benefits. With over four million Kenyans estimated to be involved in cryptocurrency activities, the proposed framework seeks to balance innovation with robust oversight to protect consumers and stabilize the financial system.

Implications for Kenya’s Financial Future

These developments reflect a broader strategy to integrate cryptocurrencies into Kenya’s financial ecosystem responsibly. By fostering innovation, enhancing transparency, and ensuring regulatory compliance, the government aims to sustain Kenya’s reputation as a regional financial hub.

As the conversation around cryptocurrency regulation unfolds, Kenyans are encouraged to participate actively, shaping a framework that ensures a secure and inclusive digital future.

Stay tuned to aKtive Citizen for the latest updates on cryptocurrency regulation, innovation, and governance

What's Your Reaction?