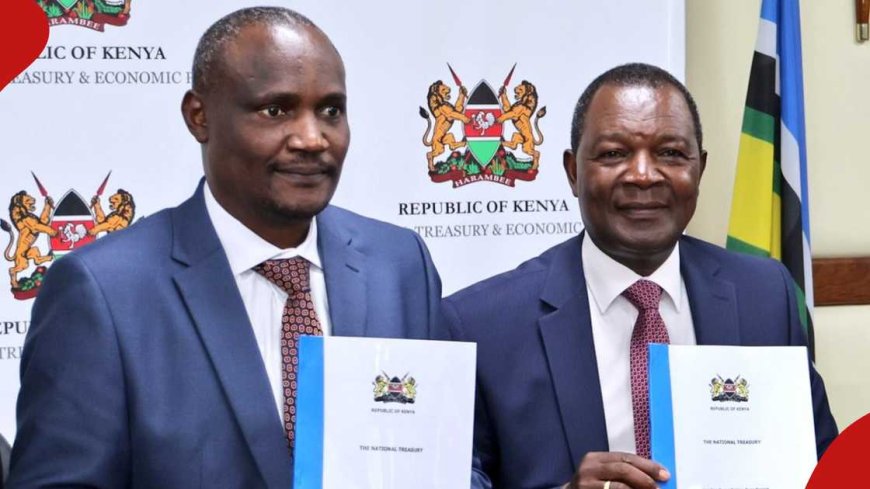

CS Mbadi proposes reduction of VAT to 14pc in Bold Revenue Strategy

Treasury CS John Mbadi has proposed reducing VAT to 14% and corporate tax to 25% as part of the Ministry’s revenue strategy. This follows the suspension of the 2024 Finance Bill and aims to simplify tax administration and boost compliance, impacting both businesses and citizens amid budget deficits. Read more...

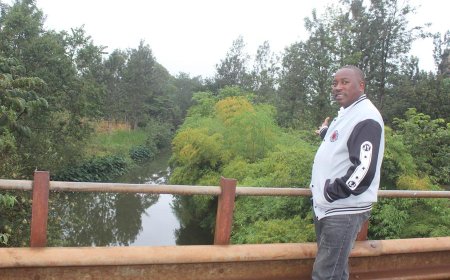

Treasury Cabinet Secretary John Mbadi has put forward a proposal to reduce the value-added tax (VAT) from 16% to 14% as part of the Ministry’s medium-term strategy to improve tax administration. This move aims to enhance compliance and broaden the tax base.

Mbadi also suggested a reduction in corporate tax from 30% to 25% and adjustments to the pay-as-you-earn tax. "I will surprise you; in the medium term, we want to reduce tax rates. We are not looking at increasing taxes," he remarked during the launch of the 2025/26 Budget Preparation Process in Nairobi.

Also Read:

For the financial year ending June 30, 2024, the Kenya Revenue Authority (KRA) reported collections of Sh313.37 billion from domestic VAT and Sh488 billion in corporate taxes.

These proposed tax cuts follow the suspension of the 2024 Finance Bill, which had sought to impose Sh346 billion in new taxes but faced public opposition and anti-government protests. In response, the government reduced expenditures by Sh177 billion and borrowed Sh169 billion to cover the budget deficit, affecting key projects like the recruitment of junior secondary school teachers.

What's Your Reaction?