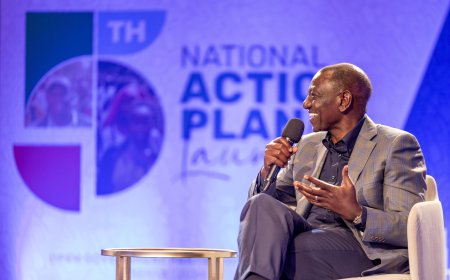

Members of Parliament have summoned Kenya Revenue Authority (KRA) Commissioner-General Humphrey Wattanga to address allegations that Kenya lost over Sh62 billion in a tax evasion scandal involving Louis Dreyfus Company (LDC) Asia PTA Limited and Louis Dreyfus Company Kenya (LDC) Limited.

The scandal revolves around misdeclaration of palm oil imports by the two companies over a span of three years. Amidst KRA missing its revenue targets, the government has been forced to increase borrowing, both locally and internationally, further straining the country’s debt burden.

The Finance and National Planning Committee of the National Assembly, chaired by Molo MP Kimani Kuria, has demanded that Wattanga appear for questioning. The committee's summons, dated August 29, 2024, outlines seven key areas of concern for clarification.

"Given the critical importance of revenue mobilization in the country, the Committee has resolved to invite you for a meeting to shed light on the matter," reads the letter from Senior Deputy Clerk Jeremiah Ndombi, on behalf of National Assembly Clerk Samuel Njoroge.

Documents presented to the committee reveal two methods of misdeclaration. One involves blending 60% crude palm oil with 40% refined palm oil and declaring it as crude. The other method involves importing refined palm oil but declaring it as crude to avoid the 35% import duty, which amounts to USD 500 per tonne.

In addition to the duty, palm oil imports are also subject to a 2.5% Import Declaration Fee (IDF), 1.5% Railway Development Levy, and 16% VAT. In Kenya, refined palm oil is taxed at 35%, while semi-refined oil attracts a 10% duty.

The committee has asked Wattanga to provide details of the total volume of palm oil imports handled by LDC Asia PTA through the Port of Mombasa between February 23, 2023, and June 26, 2024. This includes volumes of RBD Palm Stearin, Crude Palm Kernel Oil, Crude Palm Olein, Crude Palm Oil, and Crude Palm Fatty Acid Distillate. Additionally, they want information on the total taxes and fees paid by the company during this period.

Also Read:

The committee also requested import declaration documents, including port health reports, Kenya Bureau of Standards (KeBS) certifications, bills of lading, and cargo manifests for 120 shipments of palm oil imported by the company between February 23, 2023, and June 26, 2024.

In addition, Wattanga has been asked to provide details on the consignees of these shipments, as well as import volumes and taxes paid by LDC Kenya Limited, Acee Limited, Mazeras Oil Limited, and Vipingo Industries Limited.

The committee seeks complete documentation, including port health reports, KeBS and SGS reports, bills of lading, and cargo manifests related to these imports during the same period.