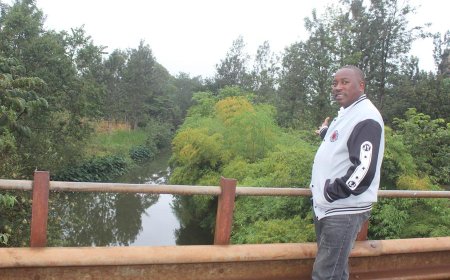

Kenya Revenue Authority Probes Morara Kebaso Over Alleged Ksh186M Tax Evasion

KRA investigates Morara Kebaso for alleged failure to file taxes on Ksh186M sales. Tax arrears of Ksh27M claimed amid denial and compliance proof submission.

The Kenya Revenue Authority (KRA) has initiated an investigation into political activist Morara Kebaso, alleging that his businesses failed to file tax returns on Ksh186 million (approximately $1.7 million) in sales over the past three years.

KRA's notice identifies five companies associated with Kebaso: Igrow Digital Enterprise, Morara Home Furniture, Luku Fashion, Morara Properties Limited (also known as Blacksmith Morara Limited), and Backtent Security Limited. The authority contends that these entities have either declared nil income or neglected to file returns, despite owning properties and engaging in business activities.

An analysis of three bank accounts linked to Kebaso and his businesses revealed deposits totaling Ksh186.3 million between 2022 and 2024. Notably, Morara Home Furniture accounted for nearly 80% of these deposits. KRA asserts that, given the turnover exceeding Ksh5 million, Kebaso's businesses should have been registered for Value Added Tax (VAT) and estimates a VAT liability of Ksh25.7 million. Additionally, an income tax liability of Ksh1.4 million is calculated for 2022 and 2023, bringing the total alleged tax arrears to Ksh27 million.

Kebaso has refuted these allegations, describing them as a political witch-hunt. He maintains that he is a law-abiding, tax-compliant citizen and has presented tax compliance certificates for 2022 and 2023 as evidence.

This development underscores KRA's ongoing efforts to enhance tax compliance and address potential evasion among individuals and businesses in Kenya.

Read More:

What's Your Reaction?